So, you're wondering how long does Chumba take to verify your bank account? Let’s dive into the nitty-gritty of this process because, honestly, waiting for bank account verification can feel like watching paint dry sometimes. Chumba Casino, one of the leading platforms out there, has a pretty straightforward system—but there are a few things you need to know before hitting the panic button. In this article, we’ll break down everything step by step, from the basics to advanced tips.

Now, imagine this: You've just signed up for Chumba, ready to play some games, and BAM—you hit a roadblock. Your bank account needs verification. Don’t sweat it, though. This is standard practice across most online platforms that involve transactions. But hey, we get it—it’s frustrating when you don’t know what to expect. That’s why we’re here to guide you through it all.

Before we jump into the details, let’s set the stage. Understanding how Chumba handles its verification process will not only give you peace of mind but also help you avoid unnecessary delays. Stick around, because by the end of this article, you’ll be a pro at navigating this whole bank account verification thing.

- Revolutionize Your Events With Mocktail Catering

- Naples Puppies Your Ultimate Guide To Finding The Perfect Furry Friend

What is Bank Account Verification on Chumba?

Alright, let’s start with the basics. When you sign up for Chumba, they need to confirm that your bank account is legit and linked to you. Think of it as their way of saying, "Hey, we wanna make sure everything’s kosher before you start playing." This process is super important because it helps prevent fraud and ensures that your transactions are secure.

Here’s the deal: Chumba typically takes anywhere from 1-5 business days to verify your bank account. However, this timeline can vary depending on a few factors, like the type of account you have or if there are any issues with the information you provided. So, patience is key.

In simple terms, bank account verification is like a digital handshake between you and Chumba. They’re basically saying, "We trust you, and we want to keep things safe for everyone involved." Makes sense, right?

- Jennifer Grantham The Rising Star Whorsquos Making Waves In Entertainment

- Hunxho The Novo 8 Jun A Deep Dive Into The Phenomenon You Cant Ignore

Factors That Affect Verification Time

Now, here’s where things can get a little tricky. There are several factors that might affect how long Chumba takes to verify your bank account. Let’s break them down:

- Account Type: If you’re using a personal account versus a business account, the verification process might differ. Personal accounts usually go faster.

- Information Accuracy: Make sure all the details you provide are 100% correct. Even a small typo can delay the process.

- Bank Processing Times: Sometimes, it’s not Chumba’s fault—it’s your bank’s. Different banks have different processing speeds, so that can impact the timeline.

- Document Submission: If Chumba asks for additional documents (like a utility bill or ID), how quickly you submit them can speed things up.

Think of these factors as hurdles you might encounter. The good news? Most of them are within your control. Double-check everything before hitting submit, and you’ll save yourself a headache.

Step-by-Step Guide to Verifying Your Bank Account

Ready to get started? Here’s a step-by-step guide to help you through the verification process:

Step 1: Sign Up for Chumba

First things first, you need to create an account on Chumba. It’s pretty straightforward—just enter your details, create a password, and boom, you’re in. Easy peasy.

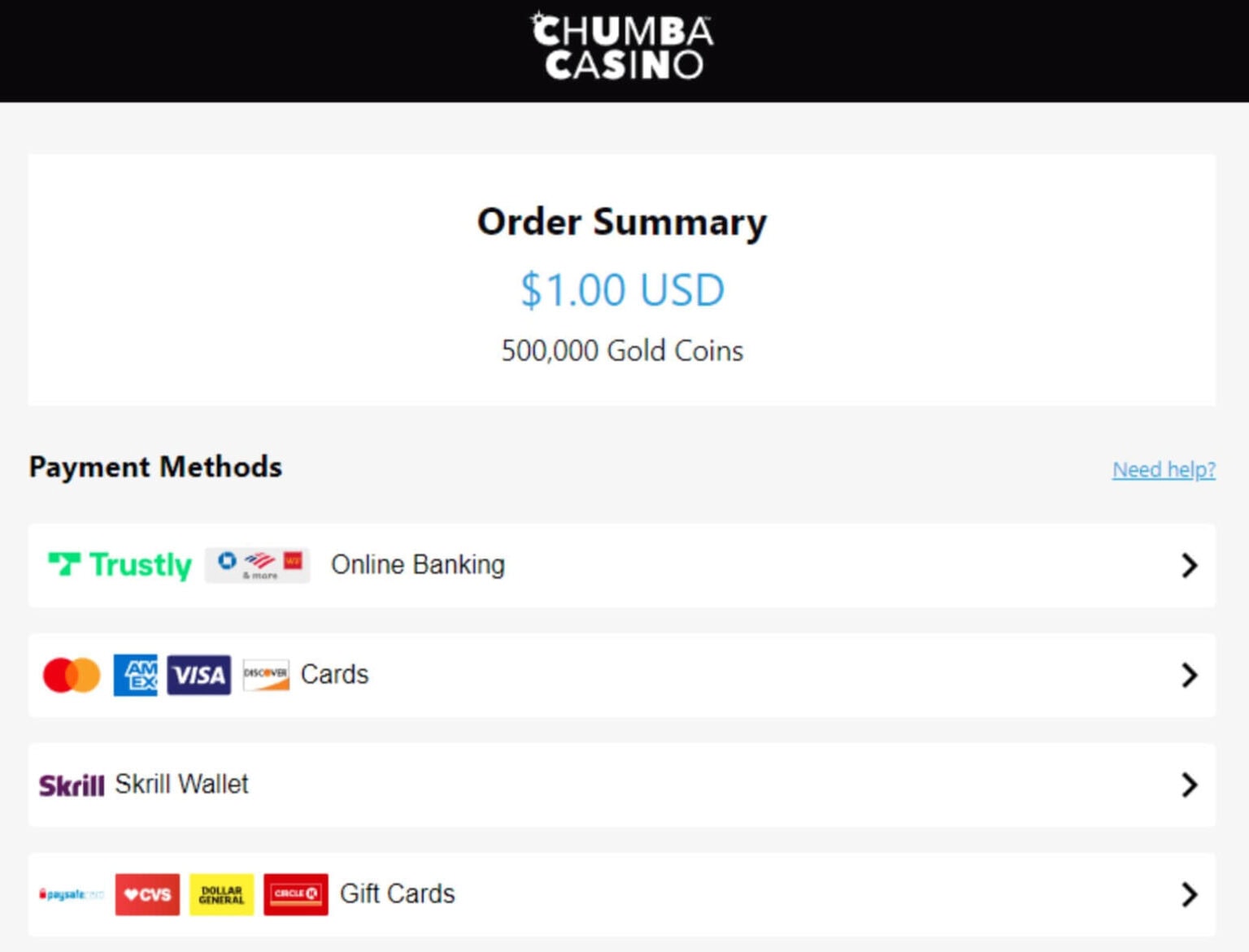

Step 2: Link Your Bank Account

Once you’re signed up, head over to the settings section and link your bank account. You’ll need to provide your bank account number and routing number. Make sure these are accurate because, remember, typos can mess things up.

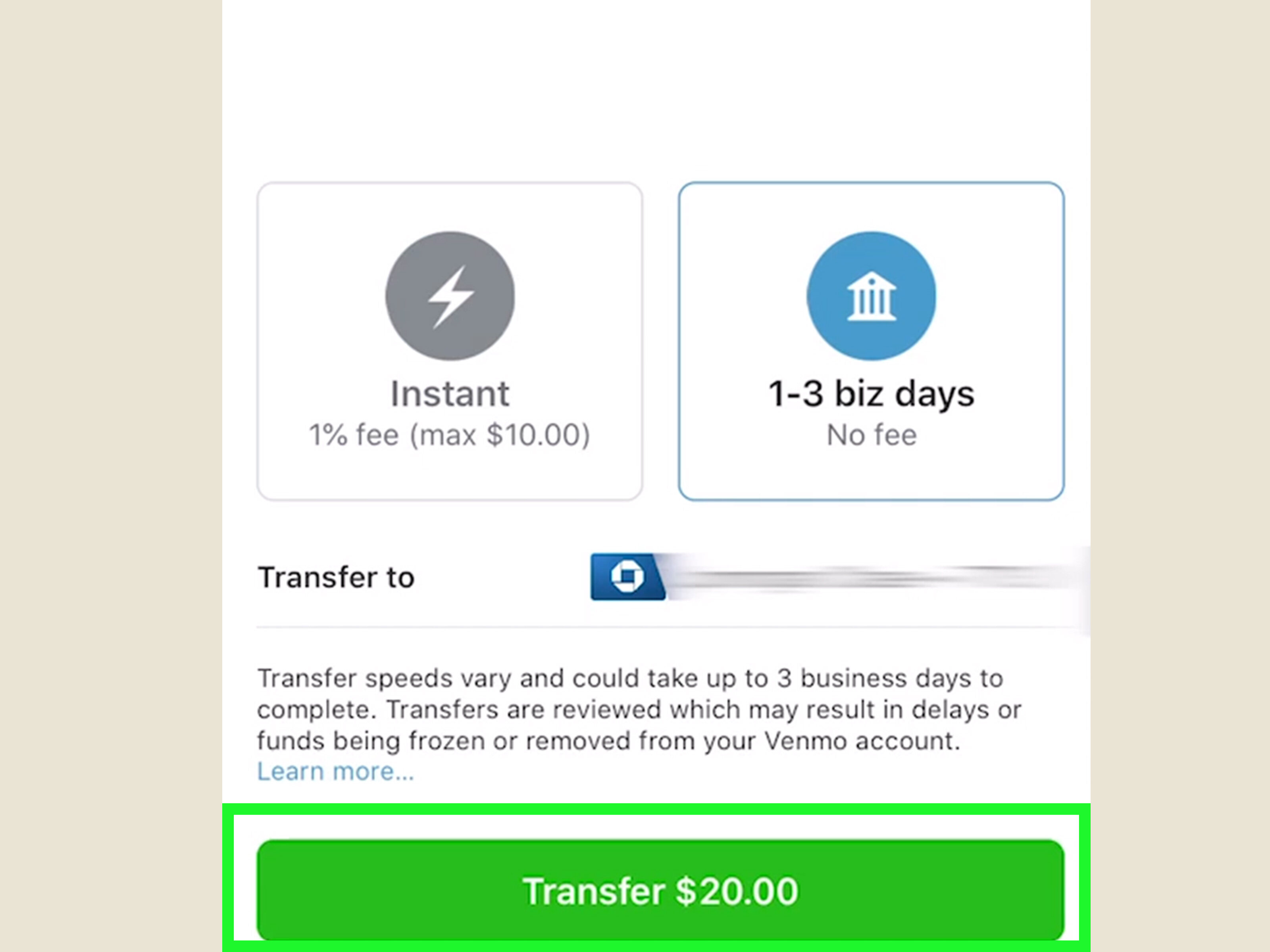

Step 3: Wait for the Micro-Deposits

After linking your account, Chumba will send two small micro-deposits to your bank account. These deposits are usually less than a dollar and are just there to confirm that the account is active. Keep an eye on your bank statements for these deposits—they usually show up within 1-3 business days.

Step 4: Enter the Deposit Amounts

Once the micro-deposits hit your account, log back into Chumba and enter the exact amounts you see. This is the final step in the verification process. Once Chumba confirms the amounts, your account will be verified.

See? Not so bad, right? Following these steps will help you sail through the verification process with minimal stress.

Common Issues During Verification

Let’s face it—things don’t always go as planned. Here are some common issues people encounter during the verification process:

- Incorrect Information: If you entered the wrong bank account or routing number, Chumba won’t be able to verify your account. Double-check everything!

- Micro-Deposits Not Showing Up: Sometimes, the deposits can take a little longer to appear. If they don’t show up within 3-5 days, contact Chumba support.

- Bank Delays: As mentioned earlier, your bank’s processing time can slow things down. Unfortunately, there’s not much you can do about this one.

If you run into any of these issues, don’t panic. Most of the time, they’re easily fixable. Just reach out to Chumba’s customer support—they’re usually pretty helpful.

How to Speed Up the Verification Process

Who doesn’t want to speed things up, right? Here are a few tips to help you get verified faster:

- Provide Accurate Information: Again, this can’t be stressed enough. Double-check everything before submitting.

- Monitor Your Bank Statements: Keep an eye on your account for those micro-deposits. The sooner you enter them, the faster you’ll get verified.

- Contact Support If Needed: If something seems off, don’t hesitate to reach out to Chumba’s support team. They can often provide additional guidance.

By following these tips, you’ll be well on your way to getting verified in no time. Remember, patience is key, but proactive steps can definitely help.

Why Does Chumba Need to Verify My Bank Account?

Alright, let’s talk about why this verification process is even necessary. Chumba isn’t just being nosy—they have legitimate reasons for requiring bank account verification:

- Security: Verifying your account helps prevent fraud and ensures that your transactions are secure.

- Compliance: Chumba has to follow certain regulations, and bank account verification is part of that.

- Trust: By verifying your account, Chumba builds trust with its users, knowing that everyone involved is legit.

So, while it might seem like an extra step, it’s actually there for your protection. Trust us, you’ll appreciate it in the long run.

How Long Does Chumba Take to Verify Bank Account? Final Thoughts

Now that we’ve covered everything, let’s recap. How long does Chumba take to verify your bank account? Typically, it’s anywhere from 1-5 business days. However, the exact timeline can vary based on factors like account type, information accuracy, and bank processing times.

By following the steps we outlined and keeping an eye out for those micro-deposits, you’ll breeze through the verification process. And if you run into any issues, don’t hesitate to reach out to Chumba’s support team—they’re there to help.

So, what’s next? If you haven’t already, go ahead and start the verification process. Once you’re verified, you’ll be ready to dive into all the fun that Chumba has to offer. And hey, don’t forget to share this article with your friends who might be going through the same process. Knowledge is power, after all.

Additional Resources

For more information on Chumba and bank account verification, check out these resources:

These links will give you even more insight into the verification process and why it’s so important.

Conclusion

And there you have it—everything you need to know about how long Chumba takes to verify your bank account. Remember, the key is patience and accuracy. Follow the steps, keep an eye on your bank statements, and you’ll be good to go.

So, what are you waiting for? Get started on your verification process today. And when you’re done, come back and share your experience in the comments. We’d love to hear how it went for you!

Thanks for reading, and happy gaming!

Table of Contents

- How Long Does Chumba Take to Verify Bank Account? Unlock the Process

- What is Bank Account Verification on Chumba?

- Factors That Affect Verification Time

- Step-by-Step Guide to Verifying Your Bank Account

- Common Issues During Verification

- How to Speed Up the Verification Process

- Why Does Chumba Need to Verify My Bank Account?

- How Long Does Chumba Take to Verify Bank Account? Final Thoughts

- Additional Resources

- Conclusion